Equity indexed life insurance (EILI) has garnered significant attention in the financial landscape, offering a unique blend of life insurance protection and stock market exposure. This comprehensive guide delves into all of these statements about equity indexed life, exploring its benefits, risks, suitability, and comparison to other financial products, providing a thorough understanding of this multifaceted insurance option.

EILI combines the traditional death benefit of life insurance with the potential for growth tied to the performance of a stock market index, creating a compelling proposition for individuals seeking both financial protection and investment opportunities.

Overview of Equity Indexed Life Insurance

Equity indexed life insurance (EILI) is a type of life insurance that combines the protection of a traditional life insurance policy with the potential for growth tied to the performance of a stock market index, such as the S&P 500.

EILI policies offer a death benefit to beneficiaries, just like traditional life insurance. However, they also have a cash value component that can grow over time based on the performance of the underlying index. This growth potential is what sets EILI apart from traditional life insurance.

There are different types of EILI policies available, each with its own unique features and benefits. Some common types include:

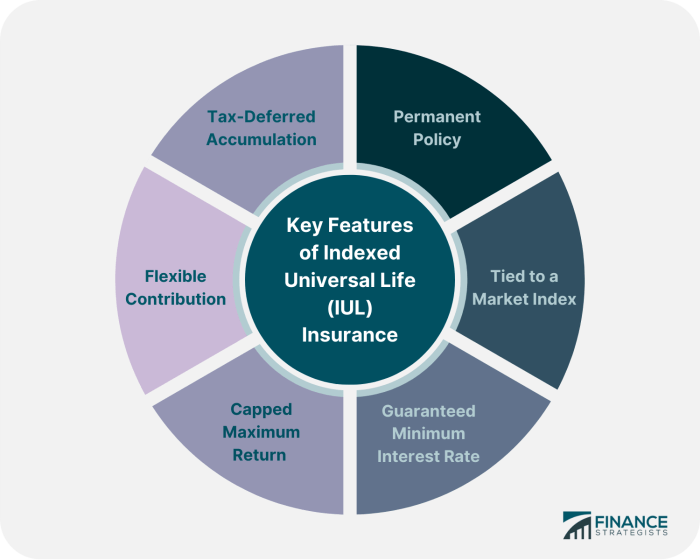

- Indexed universal life insurance (IUL):IUL policies offer a flexible premium structure and allow policyholders to adjust their death benefit and cash value over time.

- Indexed whole life insurance (IWL):IWL policies offer a fixed death benefit and a guaranteed minimum cash value growth rate.

- Indexed variable life insurance (IVL):IVL policies offer a variable death benefit and cash value that is tied to the performance of a specific investment portfolio.

Benefits of Equity Indexed Life Insurance

EILI offers several potential benefits, including:

- Growth potential tied to stock market performance:EILI policies have the potential to grow in value over time, providing policyholders with the opportunity to benefit from rising stock prices.

- Death benefit protection for beneficiaries:EILI policies provide a death benefit to beneficiaries, just like traditional life insurance. This benefit can help provide financial security for loved ones in the event of the policyholder’s death.

- Tax-deferred cash value accumulation:The cash value component of an EILI policy grows tax-deferred, meaning that policyholders do not have to pay taxes on the growth until they withdraw it.

Risks of Equity Indexed Life Insurance: All Of These Statements About Equity Indexed Life

EILI also comes with some potential risks, including:

- Market volatility and potential losses:The cash value component of an EILI policy is tied to the performance of a stock market index. As a result, it is subject to market volatility and could lose value if the index declines.

- Fees and expenses that can reduce returns:EILI policies typically have fees and expenses associated with them, such as mortality and expense charges. These fees can reduce the returns on the policy.

- Surrender charges for early withdrawals:If a policyholder withdraws money from the cash value component of an EILI policy before a certain period of time, they may have to pay a surrender charge. This charge can reduce the amount of money that the policyholder receives.

FAQ

What is the primary benefit of EILI?

EILI offers the potential for growth tied to the performance of a stock market index, providing an opportunity for policyholders to benefit from market gains while maintaining life insurance protection.

Are there any risks associated with EILI?

Yes, EILI is subject to market volatility and potential losses, as the cash value is linked to the performance of the underlying index. Additionally, fees and expenses can reduce returns, and surrender charges may apply for early withdrawals.

How do I determine if EILI is suitable for me?

Consider your risk tolerance, investment goals, age, financial situation, and long-term financial objectives. EILI may be suitable for individuals seeking a combination of life insurance protection and potential for market-linked growth.