Which of the following statements regarding risk-averse investors is true? This question delves into the realm of investment decision-making, exploring the strategies, objectives, and considerations that shape the financial behavior of these cautious investors. By examining their approach to risk tolerance, investment horizons, and asset allocation, we unravel the intricacies of risk-averse investing.

Risk-averse investors prioritize capital preservation and stability over aggressive growth. They meticulously assess potential risks and adopt strategies that minimize the likelihood of significant losses. Understanding their unique characteristics is crucial for financial advisors and investors seeking to optimize their portfolios.

Risk Tolerance: Which Of The Following Statements Regarding Risk-averse Investors Is True

Risk tolerance refers to an investor’s willingness and ability to withstand the potential losses associated with investments. Risk-averse investors are individuals who prioritize preserving their capital and minimizing potential losses, even if it means sacrificing higher potential returns.

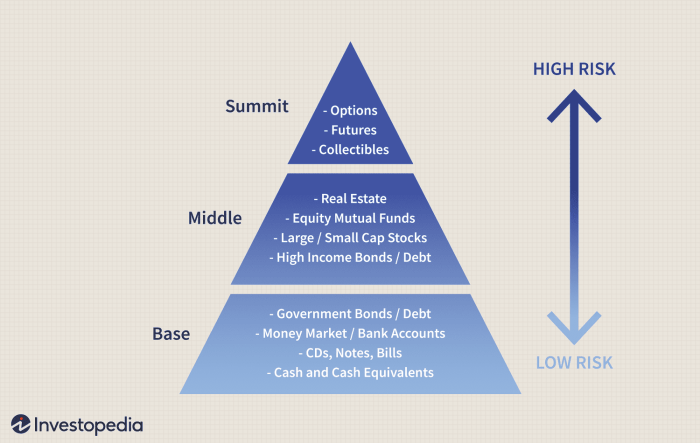

Risk-averse investors typically approach investment decisions cautiously. They prefer investments with lower levels of risk, such as bonds, cash, and low-volatility stocks. They are more likely to diversify their portfolios across different asset classes and sectors to reduce overall risk.

Investment Objectives

Investment objectives play a crucial role in guiding risk-averse investors’ decision-making. Common investment objectives for risk-averse investors include:

- Preservation of capital: Risk-averse investors prioritize protecting their principal investment, ensuring that their assets are not subject to excessive risk.

- Stable income: They seek investments that provide a steady stream of income, such as dividends or interest payments, to supplement their other sources of income.

- Moderate growth: While risk-averse investors prioritize capital preservation, they may also seek some potential for growth over time, albeit at a lower level of risk.

Asset Allocation

Asset allocation involves dividing an investment portfolio into different asset classes, such as stocks, bonds, and cash. Risk-averse investors typically allocate a higher proportion of their portfolio to lower-risk assets, such as bonds and cash, and a smaller proportion to higher-risk assets, such as stocks.

Common asset allocation strategies for risk-averse investors include:

- Conservative allocation: A majority of the portfolio is allocated to low-risk assets, such as bonds and cash, with a small allocation to stocks.

- Moderate allocation: A balanced approach with a mix of low-risk and medium-risk assets, such as bonds and stocks.

- Growth allocation: A higher allocation to stocks with a smaller allocation to bonds and cash, suitable for risk-averse investors with a longer investment horizon and higher risk tolerance.

Investment Horizon, Which of the following statements regarding risk-averse investors is true

Investment horizon refers to the time frame over which an investor plans to hold their investments. Risk-averse investors typically have a longer investment horizon, allowing them to ride out market fluctuations and potential losses.

A longer investment horizon provides more time for investments to recover from market downturns and potentially generate positive returns. It also allows risk-averse investors to adopt a more conservative investment strategy, focusing on capital preservation and stability.

Financial Planning

Financial planning is essential for risk-averse investors to achieve their financial goals. It involves creating a comprehensive plan that Artikels their financial objectives, risk tolerance, and investment strategy.

Financial planning can help risk-averse investors:

- Set realistic financial goals: Define specific, measurable, achievable, relevant, and time-bound financial goals that align with their risk tolerance.

- Create a diversified portfolio: Construct a portfolio that aligns with their risk tolerance and investment objectives, ensuring a balanced distribution of assets across different asset classes.

- Manage risk effectively: Implement strategies to manage risk, such as diversification, asset allocation, and regular portfolio rebalancing, to minimize potential losses.

- Plan for retirement: Develop a retirement savings plan that considers their risk tolerance and financial needs, ensuring a secure financial future.

Essential FAQs

What is the primary characteristic of risk-averse investors?

Risk-averse investors prioritize capital preservation and stability over aggressive growth.

How do risk-averse investors approach investment decisions?

They meticulously assess potential risks and adopt strategies that minimize the likelihood of significant losses.

What is a key consideration for risk-averse investors when allocating assets?

Diversifying their portfolio across different asset classes to mitigate risk.